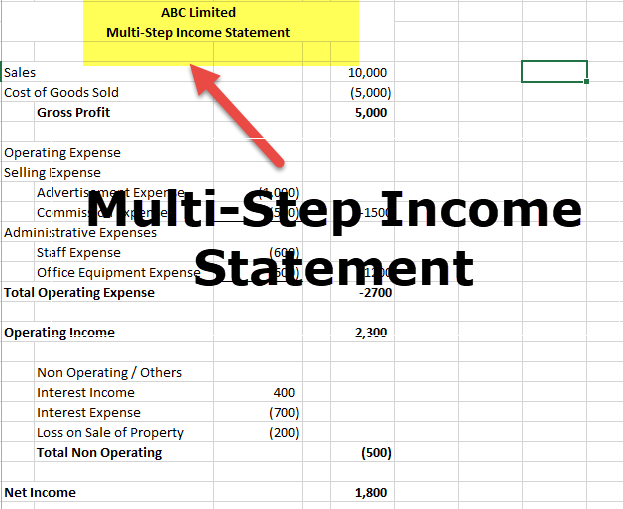

You can easily generate the trial balance through your cloud based accounting software. The income statement or profit and loss report is the easiest to understand.

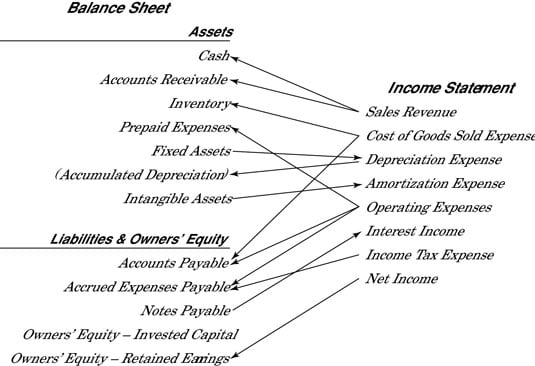

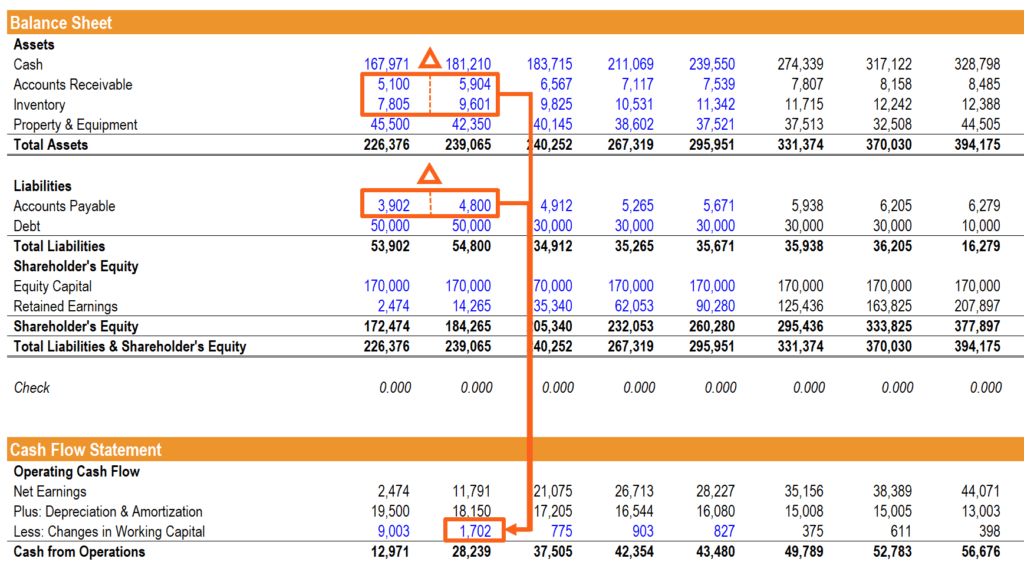

This is the balance sheet.

How to make an income statement from trial balance.

Trial balance to income statement and statement of financial position duration.

Once these adjustments have been made the income statement and statement of financial position can be prepared.

Income statement and balance sheet overview.

On our trial balance we have six sections assets liabilities expenses revenue drawings and owners equity.

To create an income statement for your business youll need to print out a standard trial balance report.

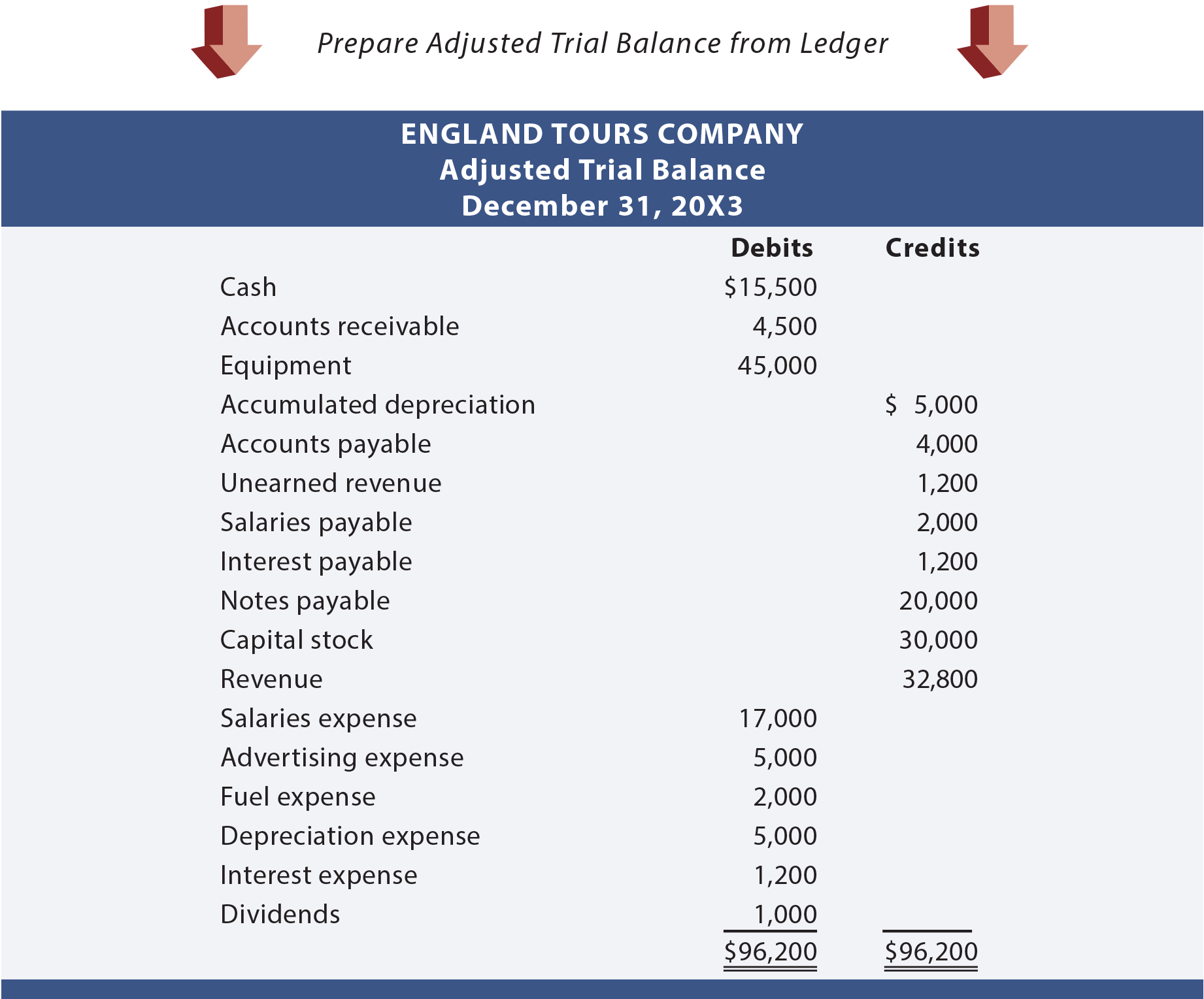

In an accounting system the best tool to take information from would be the adjusted trial balance.

Owners equity statement and balance sheet.

Trial balance reports are internal documents that list the end balance of each account in the general ledger for a specific reporting period.

The income statement totals the debits and credits to determine net income before taxes.

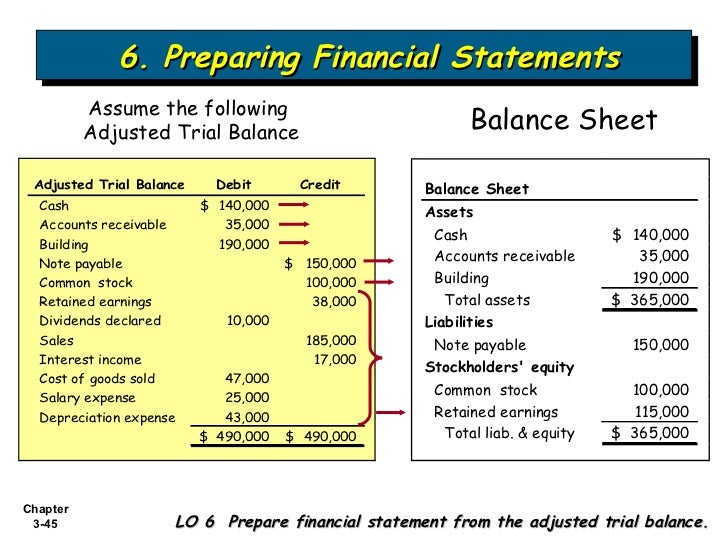

To do this we shall simply replace all the revenue accounts of the adjusted trial balance by just one line.

The purpose of the trial balance is.

Introduction to the income statement stocks.

The income statement needs to be prepared before the balance sheet because the net income amount is needed in order to fill out the equity section of the balance sheet.

Purpose of the trial balance.

To check our profit and loss were going to have the figures from two of these sections revenue and expenses.

Start by making the heading.

It lists only the income and expense accounts and their balances.

Green as at 31 march 2015 in both horizontal and vertical style.

Preparation of balance sheet horizontal and vertical style.

Green as at 31 march 2015.

How to prepare an income statement.

Report all expense accounts.

And lo and behold.

In the absence of information about the date of repayment of a liability then it may be assumed.

The income statement is prepared using the revenue and expense accounts from the trial balance.

When making the adjustments it is important to ensure that each transaction contains the correct double entry.

Prepare balance sheet for f.

Next step after the preparation of the is will be the preparation of the balance sheet.

The following trial balance is prepared after preparation of income statement for f.

The balance of the income statement bottom line of the is.

How to prepare financial statements from adjusted trial balance accounting principles.

Purpose of the trial balance.

The income statement can be run at any time during the fiscal year to show a companys profitability.

Using tasc setout requirements.

Convert trial balances to income statementsprofit and loss and balance sheet.

Report all revenue accounts.

Gather the necessary information.

If an income statement is prepared before an entitys year end or before adjusting entries discussed in future lessons it is called an interim income statement.

No comments:

Post a Comment